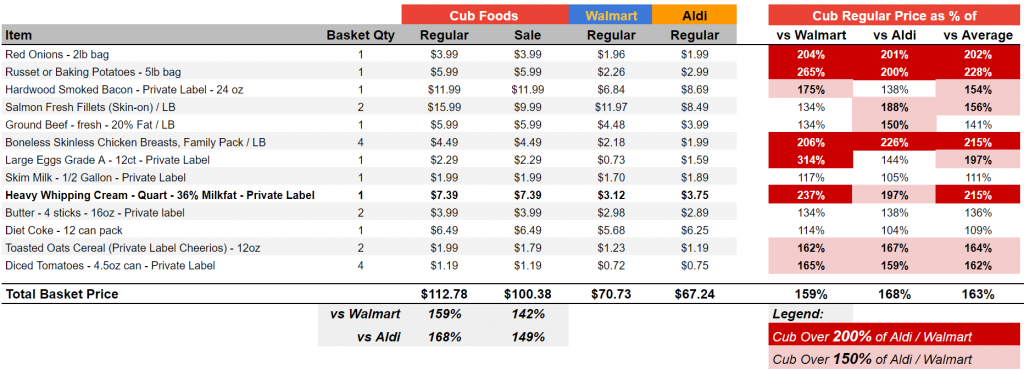

Cub Foods is priced 60%+ higher than key competitors

Many people may be noticing higher grocery bills from their average store trips over the last year, and chalk it up to inflation. True, inflation plays a role. But it turns out that where you shop matters a lot more than whether inflation is 2% or 12%. Some grocery chains may have just taken the inflation excuse on a bridge too far, with in-store prices appearing out of touch, and inexplicably higher than the competition’s. My latest research, occasioned by sticker price shock on some rather unexpected items, raises questions about Cub Foods, the Twin Cities’ largest grocer. Specifically, on a somewhat random basket of goods, Cub Foods proves a shockingly poor value, with the aggregate basket price over 60% higher than Walmart and Aldi. Some items were over 100% more at Cub than its budget competitors, with at least a few now higher than even the similar items at Lunds & Byerlys, a premium experience chain normally competing mostly with Whole Foods.

The price comparison – bad look for Cub Foods

The prices were obtained directly from store for Cub Foods (see photos), including sale prices (if Regular and Sale are shown as same, it means the item was at regular price … this shows the impact of occasional sales on the overall price of a basket. Still, even when Sale prices at Cub are compared against Regular at Walmart and Aldi, there is still a 42%/47% “premium” one pays at Cub. Prices for Walmart were collected directly from Walmart.com (accessed 2/18/2022). Prices for Aldi were initially collected from Instacart (for Aldi the Instacart prices are typically 10-12% higher than in store), and then replaced with actual in-store photos for all items I could (see photos)

The whipping outrage of a price tag gone too far

This post started with a “motivating” $7.39 price tag at the neighborhood Cub Foods in Uptown Minneapolis.

I had texted asking my wife if we needed anything, knowing I would pass by Cub on my way home on a Sunday morning (I also pass by a Lunds & Byerlys, and within a five-minute detour of Aldi and Whole Foods on the same short drive, more on this later). Arrived here in the mid-2000’s, before there was an Aldi in Uptown, I had grown to believe Cub was the reasonably-priced grocery choice, when I didn’t feel like splurging for a premium experience at Lunds & Byerlys or Whole Foods.

On this occasion, we needed heavy whipping cream for a recipe. I stopped at Cub, beelined for the dairy corner of the store, and was greeted by this image. I had not bought this item for a few weeks, maybe even months, yet this seemed a price increase gone too far, with a dash of impunity. I remembered instantly how a couple of weeks earlier, I had noticed potatoes and onions at Cub were mysteriously (and to me, arrestingly) more expensive than even at Lunds & Byerlys, a premium chain with exceptional service (which Cub Foods is not, more on this later).

Even though the purchase was still going to be small, and it was not worth the time to make a stop at another store, I felt this was an uncommonly inflated price for a common dairy item, by enough to make me feel taken advantage of (on behalf of many other shoppers, not just myself). I texted to find out if she could do with a pint instead of the quart. She needed the quart. I paid, and wondered if maybe something had happened with farms around America, and the price would be equally shocking everywhere. Later than night, I researched this item, and a basket of other common grocery items, at Cub Foods, Aldi, and Walmart.

Some items offend more than others

Why focus price comparisons on Fresh (produce/meat/seafood/dairy) and Private Label items?

These categories are where the grocery chain / retailer has most control over pricing. As the right side of the table shows, the one item from a powerful brand (Diet Coke 12-pack) showed the least variance. That is likely because such items are more likely to be remembered (pricing-wise) by consumers, and because the consumer brand (Coke in this case) has a lot of say, directly or indirectly, in the ultimate price on the shelf. The more powerful the brand / company, the more say it will have in anything from levels of trade advertising, promotions, and price guidance for the retailer. Maybe most importantly, well known items from well known brands are likely to be sold by ALL grocery chains, making price comparisons more likely, and leave few excuses for large price differentials (a can of Coke is a can of Coke, unlike, say, a piece of fresh salmon for which quality arguments can be made). These categories are where retailers, rather than consumer brands, have a choice whether to fight grocery prices inflation, or aggressively profit from it.

Produce / dairy / meat won “most overpriced” awards

This is somewhat unsurprising. These categories are both where the highest margins are, typically, for “all” grocers (add frozen/bakery/deli), and where there is the most room to argue that “my chicken is better than their chicken.” What is surprising (and most worth remembering by consumers), is how much more these items cost at Cub Foods (and thus how large the savings available from shopping elsewhere). Remember that $7.39 price tag for whipping cream I somehow couldn’t add up in the store? Turns out the same item can be had for less than half the price elsewhere. Worse, you can actually have the item for less ($6.79) even at the premium Lunds & Byerly’s, under the Glenview Farms brand (a US Foods consumer brand). No wonder grocery prices inflation is becoming an unavoidable topic from the President on down.

By knowing a few price points well, consumers can know when to vote with their feet

As my wife loves to remind me, it is unreasonable to expect from typical consumers to have great price recall or walk around with long lists of price points roughly memorized (that’s where people like me make their mark in cocktail conversations … for better or worse). But knowing what fresh chicken breasts, milk, and butter cost is not too much to ask, and it may pay rich dividends when the next grocery store decides to get in front of their skis. To really get good at this though, know prices for a couple of items that are LESS frequently purchased (whipping cream?) The retailers know which items consumers pay attention to and which they don’t, and they all use milk, eggs, and chicken as magnet prices or even loss leaders. These items allow them to advertise low prices, appear affordable in those big end of aisle displays right by the cashiers, then quietly do what they gotta do with prices in the rest of the store.

But wait, is it fair to compare Cub Foods with Aldi and Walmart? Isn’t it a different experience / segment of the market?

In short, yes it is fair, especially for consumers who are budget-sensitive. Cub Foods has long been the largest grocery chain in the Twin Cities. SuperValu owned Cub for much of that time, until it sold the chain as a distressed asset to wholesaler UNFI. Between UNFI, pandemic consumption pattern changes, and inflation / price increases, the distressed asset all of a sudden is doing well enough for the new owners to brag a little. If this post is even half right, most of it is at the expense of grocery shoppers who still choose it by inertia, for “convenience”, or simply don’t realize the price differentials involved.

For some shoppers, a Cub is a closer drive than the closest Walmart, and they may or may not know even what Aldi is (Forbes explains here). Another Forbes article explains how Aldi benefits from inflation (primarily by beating incumbents like Cub Foods). Aldi has also been steadily expanding, making it more and more likely that Twin Cities and beyond shoppers can find one as easily as their favorite Cub Foods. Aldi’s smaller store footprint allows it to go in urban areas like my own Uptown Minneapolis. The one closest to us is clean, new, well lit, and has underground garage parking (a huge plus in Minnesota winters). Its cashiers are fast and well trained, it is rarely crowded, and checkout rarely exceeds 5 minutes. There is no discernable “service premium” at Cub over Aldi, and Cub’s wider assortment only matters if you are the kind of chef who just must have that unusual herb or spice Aldi doesn’t stock.

Some Cubs are worse than others

Since we are on the “quality of experience” topic, the particular Cub in Uptown I am most familiar with is far from offering superior value on that front. It is sometimes crowded with long cashier wait lines. It has a cramped parking lot with weird angles that make avoiding accidents or being bumped a gamble. On more than one occasion, there were major discrepancies on my receipt, for example advertised promotions that were in fact not programmed / did not materialize in savings even though the conditions were met. During several of my own visits (which were not too many to begin with), price tags were absent, misleading, mismatched, or not honored at the cashier. On one visit, the store manager had to admit egregious errors on my receipt compared to price tags in the store, leading to an offer to refund the entire $50+ purchase (without returning the goods). Even accepting other locations may be cleaner / better layouts, my experiences make it extremely difficult to see any real way in which shoppers get “value” at Cub that would provide a rationale for higher prices. In “price speak”, Cub is in “value destruction” territory vs the value equivalence line … its prices are (dramatically) higher, without any corresponding value delivered.

How does an overpriced, value-deprived grocery store get away with it … for now?

Short term, even bad price increases can improve the bottom line

The pandemic has hardly been an easy time for consumers to keep track of grocery prices. The ensuing grocery prices inflation spiral is providing some reasonable rationale for many businesses to take price. Most importantly, the dislocation has made it hard for consumers to answer the simple question “what should I expect prices to be for X?” But this “soft” environment for taking price can be abused. For now, Cub Foods appears to have done okay for its new owners, providing $100M in four quarters of earnings (recall it was acquired as a distressed asset with much lower expectations, and UNFI had planned to turn around and sell it off promptly, until it didn’t). But at what cost to its long term prospects?

No “24 Hour Savings” for most, grocery prices inflation for all

Moving out of line in comparisons with relevant competitors, for items that are widely available, is a tough strategy to win with unless a grocery chain offers truly premium service, selection, and quality. I don’t expect many in the Twin Cities would mentally place Cub in the same upper tier in those categories as Whole Foods or Lunds & Byerlys. So if it’s not higher value, what is Cub’s explanation? No “grocery prices inflation” or “supply chain issues” affect Cub Foods in such disproportionate ways as to justify a 60% price premium vs Aldi. If they do, the question still remains why consumers, and not Cub’s bottom line, should pay for its comparatively poor sourcing and merchandising operations.

Until Cub comes up with a better value proposition, that heated underground parking at Aldi, or the friendly folks at Instacart that deliver for Aldi or Walmart delivery, look like the better bet. Cub Foods and UNFI may just discover that there is such a thing as taking too much price especially if “24 Hour Savings” is on your storefront.