Note: A version of this article is submitted for publication on Seeking Alpha, the world’s largest investor site, where I occasionally contribute on companies that make consequential pricing strategy decisions.

Summary

- Tesla‘s price cuts signal deep distress ahead based on even basic pricing math, with breakeven virtually certain to be unachievable.The direct admission embedded is that Tesla would rather be dependent on the taxpayer subsidy for EV’s than on its premium pricing strategy.

- Forward earnings estimates should take a hit with potentially drastic impact on stock performance.

- The future of the federal tax credit is uncertain, and its benefits increasingly shifting towards Tesla’s less pricey competitors.

- Tesla’s growth prospects are under a triple whammy: the drop in global asset markets, the saturation of Tesla’s early adopter market, and formidable competitors relentlessly closing in on product value claims.

Tesla has unexpectedly announced deep price cuts for all key models in the US, following similar moves in its other major markets, China and Europe. Ranging from 13-20% approximately, the cuts seem squarely aimed to put more of Tesla’s vehicles back in the “subsidy-eligible” category to take advantage of the (up to) $7,500 federal tax credit.

Leaving alone the deepening divide between Elon Musk’s public discourse (who needs governments and regulations?) and the giant (and disproportionate) taxpayer subsidy Tesla seems increasingly dependent on, let’s look instead of what these moves imply.

From the vantage point of pricing practitioners who may have or should have counseled Mr Musk before such a decision, there seem to be only two likely inferences.

Either:

- Mr. Musk made this decision dispensing with or overruling any advice from pricing strategy experts, or getting advice from sycophantic consultants telling him what he had decided already (buying Twitter, anyone?); or

- The plunge in demand Tesla’s data and forecasts could see coming from current levels was going to be so dramatic as to leave little alternative (Peloton slashing prices, anyone?).

I’m sure some readers will point out other possibilities I may not be seeing, so by all means, please chime in.

The Pricing Math

When advising on a price change, those of us in the pricing strategy advisory business must at the very least consider:

- What range of demand responses would make this a “profitable” action, when compared against alternatives (including doing nothing)?

- How might the competition respond?

- What impact will this have on the rest of the product portfolio demand (cross elasticity of demand)

- Will the changes in demand impact our cost structure / economies of scale?

- What longer-term implications will this have on the price perception, brand positioning, and buyer psychology?

- What will it do to existing customers (previous buyers at the previous prices)?

There is more, but every now and again the math on the first question is decisive enough that it renders the rest of the analysis nearly moot.

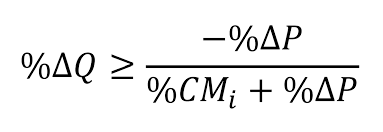

The Volume Hurdle for price changes to be profitable

When making a % change in Price (P), to achieve break even or better in profit terms, we look for a change in volume at least equal to the “volume hurdle” (popularized in Tim J Smith‘s 2012 book “Pricing Strategy”) as in the formula below.

%∆Q = percent change in quantity sold

%∆P = percent change in price

%CMi = initial $ Contribution Margin (“CM”), divided by the initial $ price.

$ Contribution Margin = $Revenue – $Variable Costs

The reason we care about Contribution Margin is that, generally speaking, price changes rarely change Fixed Costs. The elements that change and drive the breakeven analysis are Revenue (driven by Price and Quantity) and Variable costs.

Breakeven is achieved when Contribution Margin after the price change is at least what it was before the price change.

Tesla’s Volume Hurdle seems nearly insurmountable

A quick look at Tesla’s margins and their evolution over time shows Gross Margins hovering around 25%, and EBIT Margins around 16% (both exceptional by auto industry standard). (Variable) contribution margin for Tesla is not known, but it is higher than Gross Margins for manufacturers (Gross Margins subtract some allocated “fixed” costs as part of COGS, such as factory and labor directly used to make the goods sold, while Contribution Margins do not). Let’s generously assume a Contribution Margin of 45%. We recognize this is a blended margin, with higher priced models typically carrying higher % margins.

But if the Price percentage change is a cut of (negative) 13-20%, even at a blended 15% towards the lower side of that range, our formula becomes:

%∆Q (volume hurdle) = 15%/(45%-15%)=50%.

At first blush, Tesla would need units sold to increase by 50% to compensate for the price cut effectively moving contribution margin % from 45% to 30%!

I don’t think a 50% unit increase is a realistic outcome in the near future (let’s not forget, Tesla doesn’t only have a demand limit, it also has very real supply capacity limits!)

This seems too absurd, what are we missing?

In short, we’re missing three things:

- The impact of the federal tax credit (which effectively makes the price cut to the consumer, significantly bigger than its cost to Tesla); and

- The fact that our baseline should not be “previous period” margins and volumes, but rather what the forward looking numbers would be without the price cuts. In other words, if Tesla has credible forecasts and data that its volumes would plunge without a price cut, it must use those numbers in the formula, not the backward looking “good times” numbers.

- Potentially, Tesla’s unit costs may drop significantly, making the math easier at a higher CM%.

Again, when evaluating decisions, the past is sunk cost (basically irrelevant). What matters is the differential between outcome in the case we take a certain action, versus outcomes in the alternative (other options, or doing nothing).

The net impact of the tax credit is to make the %∆P (percentage price cut) even deeper to the consumer’s net price. It is difficult to calculate exactly and it would vary by which Tesla Model we’re talking about, but on a weighted basis let’s call it a further 10% “price cut”:

%∆P based on Tesla’s sticker price drop: (negative) 13-20% depending on vehicle

%∆P including impact of tax credit: (negative) 23-30% depending on vehicle. This is a generous assumption, in a scenario where “every” consumer buying would qualify for the full tax credit … in reality on a blended basis the tax credit may amount closer to 6-8%.

Still, the tax credit only impacts the consumer incentives (Tesla’s per car economics are still taking the full price cut). Most of us would still confidently say an increase of 50% in Tesla’s volume is not in the cards, regardless whether the net price decrease to the consumer is 13% or 23% (including tax credit). Let’s also not forget the tax credit is either absent or different in other major markets (China, EU).

A stretch plausible scenario where Tesla has even a remote chance to break even on this price action, is the possibility that without it, quantities sold would have plunged dramatically, on the order of 20-40% or more. From a new status quo assumption where %∆Q is -20% to -40% without lowering prices, all of a sudden simply getting Q to stay at previous levels may amount to an “increase” of up to 50% from the depressed levels Tesla would have experienced otherwise.

Again, the math is daunting. Only at dramatic expectations of Q decrease without price cuts, matched by even more dramatic hopes of reversal from such decreases in consumer response to the price cuts, does Telsa’s move come even within range of “neutral” impact on forward profitability.

What if Tesla’s costs per unit drop dramatically?

The section above on the Volume Hurdle looks incrementally better if one assumes Tesla’s CM per vehicle, while hurt by the price cut, would receive substantial offsetting help from variable costs dropping as well (another SeekingAlpha article explores this as well). This is very much possible and something Mr. Musk has hinted at before. But again, the math requires the drop in costs per unit to be quite substantial … presumably from a combination of higher volumes, economies of scale, and reversal in some of the labor market trends and supply-chain snags that drove costs up in key commodities. I find this the least improbable of the possible arguments for Tesla’s action ending up, sometime in the future, a positive for shareholders. But while directionally possible, reducing costs by 10% of revenue or more seems to me a long-term aspiration at best.

What might the future of the federal tax subsidy hold for Tesla and its pricing?

Others have long pointed out that Tesla has benefited greatly from the overall federal tax credit investment. Whether we believe Mr. Musk is or isn’t making fans in Congress, the logic of what the subsidy is meant to achieve is inescapable: breadth of adoption of EV’s, not a dominant near-monopoly that keeps being subsidized for already having a head start. The future of the subsidy is under hot debate, but we should expect on aggregate the overall federal dollars to benefit less and less Tesla’s higher range of price points, and more and more the competition that’s driving prices lower and adoption wider. Tesla’s need to “chase” the subsidy downwards on the price ladder would be an alarming concession that the days of its skimming pricing strategy are over, and most of its early adopters and wealthier prospective customers already got theirs.

The wealth effect and competition catch-up

We should not ignore the effects of the deep plunge in asset value markets across the world, and the closing of the gap in product leadership by the formidable lineup of challengers (Toyota (TM), Volkswagen (VWAGY), Ford Motor Company (NYSE:F), and GM (NYSE:GM)) , not to mention the master technology imitators in markets like China and India).

The number of people who A) really want a Tesla and nothing else, B) don’t already have one, and C) are wealthy enough to ignore price premiums that gave Tesla 8x the per-car profit of Toyota, has been taking hits on all dimensions. This may just make the possibility of Tesla’s price cut being the best of many bad options higher than meets the eye.

Conclusion

Tesla has just made its market value even more controversial. Despite its well-deserved plunge to date, the stock is still unattractive at 30+ PE multiples based on estimates that have not yet incorporated the really bad news we discussed above. The market cap is still about those of Toyota, Volkswagen, GM and Ford combined. None of the PE’s in the competitor group get to even 12x, and Tesla is subject to both earnings revisions and multiple compression.

It stretches the imagination to summon a set of facts under which this pricing move is a positive for Tesla’s profitability in the foreseeable future. Net, it’s a case of pick your poison: either this was a disproportionate reaction to “manageable” pressures on volume that will erode Tesla’s EPS for quarters to come, or it was a “best of all bad options” facing a forecast of demand plunge so deep that it would shock not just Tesla bulls, but even happy bears.

While it may raise Tesla’s grade from a presumptive F on this particular drastic price cut, from the perspective of the stock price’s prospects this would still be the worst of all worlds: the news was going to be so bad, that a price cut with a terribly narrow chance to make sense, might beat the alternative.

We could go double the length of this article exploring all the other level 2 and level 3 implications pricing experts typically look at, but we leave this to others and to future analysis relying on future management disclosure.

Please don’t forget to hit the “Subscribe” button on our LinkedIn newsletter!