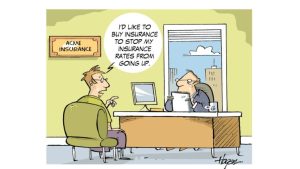

Illustrating the point

Consider the following title and the story in the article: Passengers Left ‘Gutted’ After Etihad Airways Cancels $300 Australia – Europe ‘Mistake Fares’

Apparently prices are so easy to lower, a dumb computer glitch can do it … with rather untenable consequences. The article, admittedly an extreme case, illustrates nevertheless some memorable truths about lower prices:

- Customers can turn on a dime from feeling something is a terrific bargain, to feeling they are thoroughly entitled to it

- Customers can argue in the same breath about how highly they value the product / service, and about how it should belong to them at a throwaway price (a bit of “endowment effect” once they feel it belongs to them)

- Price decreases, just like price increases, flow directly to hurt / help profits, especially if they don’t affect volumes sold. Once an airplane is full, no amount of price reduction can procure even a single extra ticket sold (not that this would by itself compensate for lost profits anyway)

- Precedent-setting can further hurt a business’ future ability to stay viable, by anchoring future expectations at unrealistic levels. In the particular story here, it is doubtful that honoring the tickets already sold would have bankrupted the airline. Nevertheless, Etihad wisely protected itself by using legal protections that exist in the small print … for this reason. This illustrates Jeff Bezos’ point: few can withstand for long the full fallout from unwisely (and in this case, extremely) lowering prices.

- This article would have also made for a good illustration for another one of our favorite quotes, featured last week: “The moment you make a mistake in pricing, you’re eating into your reputation or your profits.” — Katharine Paine

Fine-tuning the point

Quotes are memorable because they may sound like universal truths. In practice, they rarely are. So for every quote we feature at EBITDA Catalyst, we will provide some caveats, if we believe without them the quote could be misunderstood or misapplied. The following caveats apply to this Jeff Bezos quote, in our view:

- “Smart” price discounting, promotions, and other fashions of “lowering prices” can in fact be not just “easy to afford” but profit-accretive. However, the “smart” qualifier typically makes these far from “easy” to identify and calibrate … many promos still lose money for the firm when done on “cruise control / repeat cycle”

- Jeff Bezos was undoubtedly thinking of “straight-up” price lowering, as in price wars and races to the bottom. There are many forms of packaging, bundling, and introducing lower-price versions of products that fit under the “smart lowering” umbrella, where they may result in some lower price points being available, but usually in some form of feature-deprived product (think low-cost airline stripped down fares), or higher $ gross margin contribution. These expand the addressable market for the firm / industry and the overall profit pool, and are therefore not “hard to afford”.

- Finally, Mr. Bezos was thinking about a low margin, high volume business like Amazon’s core retail business. Extremely high profit margin products, like software, or new products (iPhones?) introduced at “skimming strategy” prices, often come with a pre-existing strategy that at some point their prices will be reduced, either as newer versions are introduced, competition catches up, or the super-high willingness to pay (WTP) customer pool is exhausted and the product must next address a wider audience.

Want more Catalyst Quotes and other insights?

Follow EBITDA Catalyst on LinkedIn: https://www.linkedin.com/company/ebitdacatalyst/

Check out our Pricing Quotes page, where you can submit your own favorite. If you are a pricing professional or someone who just thinks about pricing a lot, feel free to submit your own words of wisdom and we will quote YOU (if we find it quotable)! https://www.ebitdacatalyst.com/quotes-on-pricing/