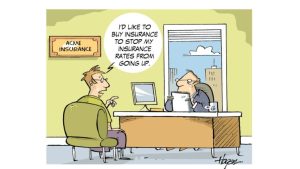

Illustrating the point

It’s the make-or-break holiday season for retailers and consumer brands, and the words “promotional environment” are everywhere. Categories like footwear and apparel, which are both seasonal and often discretionary, seem to be particularly sensitive to “how promotional” to get in this environment. Even brands like Lululemon, who take pride in a “no discounting” mantra, face questions on earnings call about the impact of promotions, both theirs and their competitors. Mainstream footwear darling (and lower price point) brands like Crocs can’t get out of their earnings calls without at least 10 mentions of promotion-related topics.

What did “promotion” mean then, and what’s the relation to price promotions today?

So does this mean that timeless showman, politician and promoter P.T. Barnum had it right? Let’s be careful here … to illustrate the point we must first agree on what the point was. “Promotion” is not the same thing and does not automatically involve “price promotion.” For the businessman of the 19th century, “promotion” would have meant everything that would make customers come: advertising, word of mouth, sensationalist claims combined with true entertainment value (which, in circus as well as in politics, is typically all the customer value one should expect to receive). Most likely, rather simplistic pricing with low price points to draw large crowds were also understood as “promotion.”

Though it’s been a longish time since the 19th century, the balancing act between creating customer value, influencing the customer’s “perceived” value, and charging a price that captures as much as possible the willingness-to-pay (WTP) remains. While customers today have a lot more information about quality, prices and competition, brands and retailers also have much more sophisticated tools and strategies to help them deploy “promotion” of all kinds.

To begin, some brands make price promotions an “inevitable” part of their strategy, whether in CPG, apparel, footwear, other consumer durables, or electronics. The move towards online shopping and price-comparison sites and price-match guarantees have made it harder for brands to hold the line in relatively commoditized categories or subcategories.

Price promotions pressure in the current environment

In the current environment, several factors conspire to increase the pressure to deploy price promotions:

- Many brands have taken significant price increases in the last two years, often supported by constrained supply chains that limited supply during the pandemic, and by pent-up demand in some categories of the stay-at-home economy. Initially, consumers went along and paid up, with price elasticity softened by excess stimulus cash and decline in other spending categories in the economy supporting higher WTP. But as some of those abnormal conditions are normalizing or reverting to the mean, consumers are less amenable, and both willingness and even ability to pay retrench.

- There’s been a inventory whipsaw, with brands and retailers placing much larger orders during the pandemic to try to gain control over enough supply, lower costs per unit, and manage down the impact of exploding freight costs. Together with shifts in consumer demand patterns and categories of focus as Covid re-opening and return-to-work took hold, this resulted in abnormally high inventory levels, often for categories or models of goods that consumers have declining need or appetite for. Especially for perishable or seasonal goods, the pressure to mark down or face total write-offs whipsawed right back. Witness shockingly bad quarters at Target and Walmart, among others, in the last few months.

- Even premium, differentiated brands face some pressure when their lower-value competitors go into deep promo / markdown mode. While the use value of a $100 Lululemon pair of tights should be the same, the willingness to pay will change for at least some consumers if a cheap competitor that sold passable quality tights for $40 now sells them for $20. While Lululemon held the line fairly well on pricing “given the promotional environment”, it still had to guide lower for overall 2022 earnings, most likely driven by expected slowing volume growth. The market promptly sold off the stock from the $380s to $320s range, a drop of about 15% from its admittedly lofty valuation.

Fine-tuning the point

Quotes are memorable because they may sound like universal truths. In practice, they rarely are. So for every quote we feature at EBITDA Catalyst, we will provide some caveats, if we believe without them the quote could be misunderstood or misapplied. The following caveats apply to Mr. Barnum’s “promotion or death” sentence:

Some of the most successful brands out there, like Lululemon or Birkenstock, “promote” the demand for their products in highly effective ways, without resorting to price promotions or relegating any notion of discounting to the very last resort.

- Delivering truly outstanding products that “promote themselves” with quality and word of mouth, and sometimes the occasional celebrity influencers (endless “social proof”)

- Creating experiences around their products that promote a sense of well being, status, and exclusivity (have you visited a Lululemon or Birkenstock store?)

- Managing supply intelligently to promote a sense of pent-up demand, with high sellout and sell-through for the most desirable models being the norm (capitalizing on high differentiation, basically no competition that feels the same to their core audiences)

Promotion effectiveness and optimization have become increasingly essential tools of pricing excellence.

- Brands that either deliberately promote (HiLo pricing strategy brands), or simply exist in a category where promotion is unavoidable (grocery) must invest in expertise and tools to drive ROI on their promotional budges. TPM (Trade Promotion Management) and TPO (Trade Promotion Optimization) tools can make a difference for the largest brands, while middle market or smaller brands must create in-house processes and measurements that at least deliver 80/20 solutions.

- Brands that sell through powerful retailers like Walmart and Target that demand vast trade and promotion investments must insist on the ability to measure return, and train their teams in advanced selling and negotiations techniques with lots of large-dollar items available as “give-gets” and the best prepared often emerging with better terms

- Rebates management must be razor-focused on pay-for-performance/growth/profit principles (rather than just pay rebates as a glorified discount that doesn’t need to be earned) through in-house analytics and purpose built measurement tools and sales teams training, or leveraging advanced solutions for large enterprises like software from our partners Enable.

Want more Catalyst Quotes and other insights?

Follow EBITDA Catalyst on LinkedIn: https://www.linkedin.com/company/ebitdacatalyst/

Check out our Pricing Quotes page, where you can submit your own favorite. If you are a pricing professional or someone who just thinks about pricing a lot, feel free to submit your own words of wisdom and we will quote YOU (if we find it quotable)! https://www.ebitdacatalyst.com/quotes-on-pricing/