Recap

- Understand your current margin profile(s) and the relationship to your pricing stance

- Rebalance pricing with renewed focus on other Customer Lifetime Value levers

- Use your e-commerce / DTC channels as “advanced detection and testing” for consumer behavior trends

- Enhance use of price architecture & available “off-ramps” to mitigate churn or defections

- Redefine “right products” with an eye on themes 1-4 and double down on pricing & product research for “big dollar” products

Topic #2. Customer Lifetime Value - Broadening the Lens

- One of the most successful retailers on the planet is reading poorly what consumers want / can still afford

- A significant % of consumers are no longer able to afford everything retailers thought they would

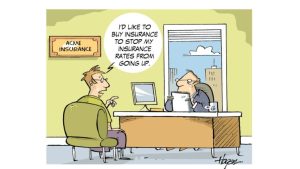

This brings us to the question: are there levers of revenue management and CLV that companies should refocus on, in tandem with nimbler pricing?

Customer Segmentation

- Allow you to identify which customers fall into which segments at any given time (not waiting on an annual or bi-annual segmentation “cycle”)

- Be as close as possible to real-time, e.g. changes in customer behavior should, if significant, result in customers migrating between segments

- Lead to different / targeted treatments with every lever: price, promotion, email marketing, products / offerings recommended, retention tactics, etc.

Depending on industry and where your customers buy, this may recommend different segmentation frameworks. At one end, a “clean and instantaneous data” channel like e-commerce, allows brands to implement segmentation meeting all the requirements above. At the other, selling through retail and getting no POS / individualized transaction data, means effectively you don’t know who your individual customers are, and must rely on surveys and customer insights techniques instead. We discuss in topic #3 the use of e-commerce / DTC as a proxy when a brand’s channels span some where it can track customer behavior and some where it can’t.

What can companies do? RFM segmentation.

Where brands do capture individual transaction data linked to each customer, we like RFM segmentation as a first resort. It is simple, intuitive and often an 80/20 approach to get actionable insights. Each customer gets assigned a bucket/score from 1 to 5 for order Recency (R), order Frequency (F) and total order Monetary Value (M). In its simplest version, on each of these dimensions, customers are ranked in quintiles and assigned the relevant score based on where they rank across the distribution. In other versions, you can create custom ranges for each score. Each customer then ends up with a 3-digit score, from 1-1-1 (worst on all 3 metrics) to 5-5-5 (best on all 3 metrics). Since this results initially in 5*5*5=125 combinations, you can group “close enough” combinations in segments.

Note: A number of companies offer automated, real-time RFM segmentation features as part of e-commerce or pricing software solutions. Our partners at Omniconvert use a relatable set of names for their e-commerce customer segments.

In the segmentation performed with Omniconvert’s Reveal solution above, only a 5-5-5 RFM score defines the “Soulmate” ideal customer. By contrast, to qualify as a “Lover” the customer must still be pretty darn great, but is allowed to be imperfect, particularly in the M score (total dollars spent).

On the right, the less appealing segments each get a relatable name, but if you’d rather be less creative, you can define your own.

Once segments are defined, customers’ behavior (in this RFM case, limited to ordering behavior) automatically migrates them to new segments, and can drive appropriate treatment, offers, and retention efforts. Just as importantly, it can drive how to think about optimizing new customer acquisition.

Customer Acquisition

Brands evaluating their CLV optimization levers have had to navigate a sea change in customer acquisition too. Whether it is the impact of Apple’s privacy changes diminishing ROAS for Facebook ads, lower website traffic post-pandemic, or the softening consumer, brands are facing headwinds and in some cases markedly declining performance. Metrics like ROAS (Return on Ad Spend), CAC (Customer Acquisition Cost) and CLV/CAC ratio are generally moving in the wrong direction.

What can companies do? Better targeted customer acquisition

First, companies should use the customer segmentation engine (see above) towards better customer acquisition. For example, with Facebook’s ability to build target ad audiences impaired by Apple’s privacy changes, brands can use their own existing customer segmentations to allow Facebook to build look-alike sets of their best customers. In the example above, using the Omniconvert RFM terminology, a brand could feed Facebook its Soulmate and Lover segment data, resulting in better targeting and higher ROAS.

Second, brands should stop acquiring unprofitable customers. A recent cohort analysis we did for a brand’s Shopify store, revealed that cohorts acquired during the pandemic are much lower quality (and much higher volume of customers) than historical cohorts pre-pandemic. A possible explanation could be lower-income consumers splurging for a one-time purchase but unable to become repeat customers. Another could be bored stay-at-home pandemic captives “experimenting” with purchases they never intended to turn into a relationship with a brand. A detailed cohort analysis can reveal, for example, the one-and-done customers in low quality cohorts to use for look-alike audiences NOT to target / acquire.

Finally, brands should use segmentation and NPS monitoring / surveys to refine their understanding of their customers’ true “Jobs to Be Done” (JTBD). Then they can refine ads and introductory offers that speak to those key customer aspirations to overcome purchase hesitations, and reinforce both purchase intent and customer satisfaction post purchase with customized email and CS treatment.

Note: Solutions like our partners at Daasity, integrate data feeds from across your DTC, Amazon, Google / ad platforms and more to help brands track real-time performance and react quickly to changes with customized automated treatments in Klaviyo, Facebook, and more.

Loyalty Programs

Recall the distinction above between brands that can and those that can’t track customer behaviors and purchases (ideally across the omnichannel)? Loyalty programs can be a great investment to improve your visibility and effectiveness across channels and positively impact all the other CLV levers.

- Customer & pricing segmentation: it gets easier / more realistic when firms can “follow” individual customers and collect data on transactions across multiple channels. Loyalty programs allow the customer’s transactions to be recorded across DTC, owned retail, and more. Further, self-selection into the loyalty program is in itself a potential segmentation criterion, and creates a great avenue for targeted pricing for your best customers.

- Channel mix: a loyalty program can be a great influencer in getting some customers to shift purchases to a brand’s owned channels (DTC / Owned Retail), which are also a brand’s highest-margin channels.

- Retention strategy: loyalty, like nearly everything else, is worth more when it’s in scarcer supply. There’s a much wider set of options for re-engaging or delighting customers that are already on your loyalty plan, making them feel special with a great email, with a special greeting the brand’s owned retail store, or even with a handwritten card.

What can companies do? Introduce loyalty programs, where the scale and channel fit are present

For all their valuable contributions, loyalty programs will not be for every company out there. There are meaningful “costs of admission” to administer more sophisticated programs, including fixed costs like investments in data infrastructure, software, and an implementation or consulting partner to get it started and administer points, redemptions, and more. To make these a higher ROI investment, scale helps. Firms with a large % of overall revenue from channels where they can get the POS data can also ensure higher “penetration” of the loyalty program and broader “coverage” of the total picture of their customers’ activities. It is unsurprising then that retailers, banks, distributors, airlines, and hotel chains are some of the largest users. We learned much of what we know about loyalty programs from a well-respected leader in the space, RAZR Marketing.

But even smaller companies, if they sell goods or services with highly recurring purchase patterns, can use programs like Autoship or Subscribe & Save to create a simplified version of “rewards for loyalty” and segment their loyal customers into a higher value offering. We helped a leading pet food brand configure such a program … a company that ensures pets get fed delicious food reliably is the perfect business to think about loyalty!

Topic #3. E-commerce / DTC as “advanced detection system” for customer behaviors & trends

In a fast-moving market, decisions are only as good as the timeliness of the data we base them on. Not only has DTC / e-commerce grown dramatically during the pandemic and become a more important profit engine than ever before. It also remains your fastest / best controlled data acquisition channel to keep a read on your customers. In fact, the toolset to do so has gotten better.

With regards to pricing decisions in particular, if you are a brand that has both traditional/big box retail, and DTC/E-commerce, the latter gives you the only avenue to:

- Get an even remote estimation of the price response and sensitivity of your end customers, and understand which segments respond differently, when.

- This is virtually impossible w/ lumpy sell-in data to your retail partners (effectively B2B market) or even syndicated SPINNS / Nielsen / IRI data (for those segments/categories in Consumer fortunate enough to get any).

- Pricing research surveys like Van Westendorp and Conjoint Analysis can provide some directional estimates, but they have caveats (additional cost, hard to do on your own, and did we say “limited” estimates?). They are much better used for important product research (which we cover in the future Topic #5).

- Get transaction data you can actually trust / dissect at the transaction & customer level

- Get a picture of customer cohort behaviors, seamlessly linking all behaviors on a given property

- Get your customers to respond to offers / retention / delight tactics in real time (thus possibly A/B test etc)

Importantly, the points above also apply to your competitors, and your ability to read their moves sooner. In categories where both you and the key competitors have significant DTC / Ecommerce channels, failing to plan for competitive monitoring, may well mean planning to fail.

It is true that the E-commerce/DTC read has its own limitations (foremost, it reads an already self-selected segment of consumers who chose to beat a path to your website, thus momentarily relinquishing the immediacy of comparisons / alternatives available on the retail shelf). The magnitude of consumer behaviors may be different in the retail channel. But for quick directional reads and testing of pricing and CLV tactics, DTC has unique advantages. And in this market, speed-to-insight, test reads before the all-in, proximity to customers, and getting DTC right for its own margin dollars’ sake, have all gone up in value dramatically.

Conclusion

When the one-directional pricing moves start running into riskier territory, we recommend that firms refocus on the broader CLV toolset. They should act, whenever possible, informed with a faster and clearer lens trained on clean, real-time DTC / E-commerce data, augmented with the right segmentation and visualization tools. As we argued in Part #1 of this series, pricing strategy and execution themselves should be broadened away from “always increase” and “one-size-fits-all”. As Walmart is proving today, any one of a full range of pricing levers (yes,including discounting) may be the right answer for a specific firm’s situation. But much as we love the focus on pricing, without balance across the other CLV levers we suggest here, firms can forgo other important opportunities.

Bottom line: Einstein warned that “Insanity is doing the same thing over and over and expecting different results.” We would offer the variant “Insanity is doing the same thing in a dramatically changed environment and expecting the same results.”