The Bull Market for Pricing Actions: Is It Over?

That bubble-burstin’ feeling.

It’s been a bull market (with some bubble symptoms) for price increases. Some were thoughtfully and strategically done. Others were rushed, me-too, fear-of-missing-out (FOMO) affairs. Whether brands did one or the other or something in between, we’re not here to judge. A lot of indicators tipped the scales in favor of price increases. You acted, and now it’s time to deal with the reaction. Except, in many industries and categories, the economic environment has changed dramatically in a few short months. This ups the ante on having both your Pricing and your Customer Lifetime Value strategies more responsive than ever.

(Really) bad news can offset even great pricing, in the short term.

Inflation is skyrocketing, asset prices & valuations are falling, costs and supply chain shortages are eroding profits. (Some) B2B and B2C market segments are facing slowing demand. Walmart and Target reported giant mismatches in their inventory vs demand, a sign that even the most sophisticated and data-rich are being surprised by consumer demand patterns. Using a poker analogy, for a while it felt out there like most brands held a pair of aces or kings, and the only question was how much and when to raise. Strangely, it also felt like everyone was playing against the casino (all that slosh of cheap money available for the taking) instead of the usual competition. Then we all got a really bad flop. Then an even worse turn. For some, we may soon get a river that puts a dent in both confidence and profits. The casino funding the game we all seemingly could win just by showing up is out, and competing for softening demand is back in.

Does this mean any and all price increases are now a bad idea? Does it mean it’s time to “fold” away from pricing levers altogether?

No, and hell no. “There’s always a bull market somewhere” … they say. There are always opportunities for better pricing, too, especially when seen in the broader context of CLV & Revenue management. This market is merely serving notice that consistent and resilient pricing success is not that easy, after all. That it’s a process, not an event. That profiting from pricing over time still requires investing in the value of your offerings and in your pricing capabilities.

Just like poker, in pricing one can still lose with what looked like a great hand. One may have played it poorly, failed to read the table, pushed in too many chips, or simply got terribly unlucky (a rare event, just like getting terribly lucky). The expert player knows how to tell the difference and has a plan to use each loss, even the all-in loss, to get better and win a lot more over time.

Now What? Five To-Do's To Improve Pricing Outcomes In A Tough Market

Here are five areas where your focus could improve your reactions to this market:

- Understand your current margin profile(s) and the relationship to your pricing stance

- Rebalance pricing with renewed focus on other Customer Lifetime Value levers

- Use your e-commerce / DTC channels as “advanced detection and testing” for consumer behavior trends

- Enhance use of price architecture & available “off-ramps” to mitigate churn or defections

- Redefine “right products” with an eye on themes 1-4 and double down on pricing & product research for “big dollar” products

We discuss theme #1 in more detail below, and leave themes 2-5 to future blogs. My colleague and pricing guru Stephan Liozu also has a good piece with additional great ideas here.

#1: Understand margin profiles and the relationship to your pricing stance

Simply put, your profit margin profile (specifically, your Variable Contribution Margin) has very significant implications for how you should react to perceived customer softening / price sensitivity. Counter-intuitively, firms that start with LOWER margins have a much more favorable margin for error when customers react unfavorably to price increases. Conversely, firms w/ HIGHER margins can’t afford to lose many customers, because each lost customer is “costly” in relation to the overall $ margin benefits of the price increase. Ideally such analysis would have occurred before any pricing actions, but it holds an important sway over the “next moves” playbook as well.

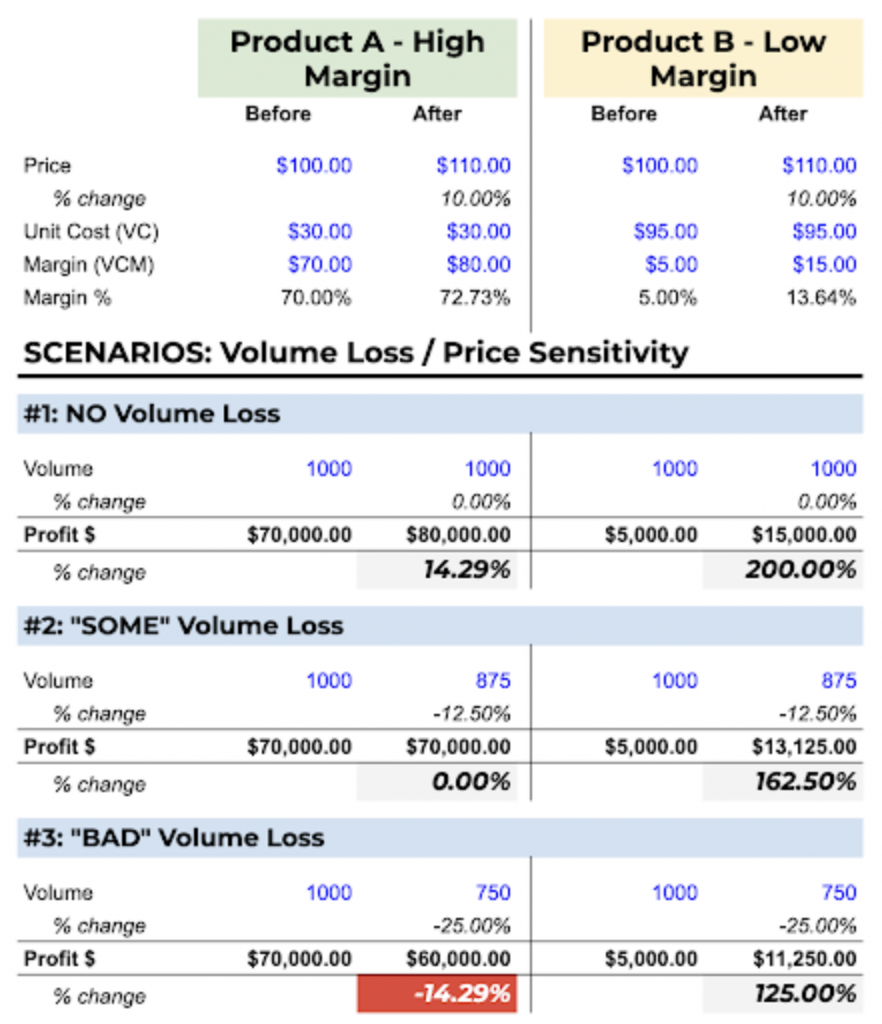

Consider the table below with hypothetical Product A and Product B illustrating high-margin vs low-margin. Both products start at $100 price, and take a 10% price increase. We then illustrate 3 scenarios for “None”, “Some,” or “Bad” volume loss (theoretical price sensitivity).

The implication is obvious: the HIGH margin Product A is much more vulnerable to unfavorable volume response to a price increase than the LOW margin Product B.

What's going on here?

For Product A, a mere 12.5% loss in volume would wipe out any $ margin gains from the price increase, resulting in break even. A larger volume loss of 25% would result in sizable margin $ loss on top of the revenue loss. These are admittedly examples of higher price elasticity, but the point is that the $ margin outcome is “highly levered” to the volume response.

By contrast, Product B is sitting pretty even after a relatively dramatic 25% volume loss, still up in $ profit by 125% vs Before. So Product B, on a percentage change basis, presents both higher upside and lower downside in $ margin contribution than Product A. In a sense, Product A is a “levered” pricing bet, while Product B is “unlevered”.

Note 1: The “HIGH-margin A vs LOW-margin B” comparison holds in general not just for individual products, but also for entire Product Lines / Families, Business Units, or entire Companies. Finance folks use the term “operating leverage” to explain why companies with a high ratio of Fixed Costs / Total Costs show a stronger response to volume changes (think Software / SaaS companies where nearly the entirety of costs is Fixed, while unit costs to sell an additional DVD-Rom or digital subscription are very small). Our A is closer to Software economics / Google, and B is closer to every-day-low-price (EDLP) retail goods / Walmart.

If you are facing early signs of significant volume changes following a price increase, it is essential to know for each of your important products if you are closer to Product A or Product B dynamics. If you are in a high margin business like Product A, the importance of early reading and planning for inflection points in your pricing tactics is significantly higher. You should already be thinking about the themes 2 – 5 we will explore in the updates to this blog.

Conclusion

If you are facing early signs of significant volume changes following a price increase, it is essential to know for each of your important products if you are closer to Product A or Product B dynamics. If you are in a high margin business like Product A, the importance of early reading and planning for inflection points in your pricing tactics is significantly higher. You should already be thinking about the themes 2 – 5 we will explore in the updates to this blog.

Conversely, few businesses are so low-margin to resemble Product B. If you are, the pressure is always on to sell enough volume, and you probably rarely if ever would take a full 10% price increase. While you too will benefit from themes 2 – 5, you have more time to get your next moves lined up, and you’ll still have dollar gains from the price increase to help you pay for them. Depending what you’re looking to maximize, you may well have areas in your portfolio where there’s even room for further targeted increases as costs pressure mounts.

Bottom line: There are levers and strategies, from pricing to the rest of the CLV tool set, that give you great options to act thoughtfully. Panic, just like hope, is not a strategy!

Meet: Stephan Liozu