Sometimes, an inflexible, one-size-fits-all pricing strategy can turn into a major liability in a rapidly changing market.

On Friday, November 5, shares of Peloton fell by over 35%. The stock is down over 2/3 from its January highs. In early trading Mon, it is down another 8%. For a company that not too long ago was unable to make enough product to satisfy demand and spent over $400M to acquire more manufacturing capacity, this seems like a stunning turn of events.

Until, that is, one reviews the numbers Peloton posted in its quarterly earnings release after market close on Thu, and the impact of its latest changes in pricing strategy. Let’s first dive into the very alarming financial outcomes:

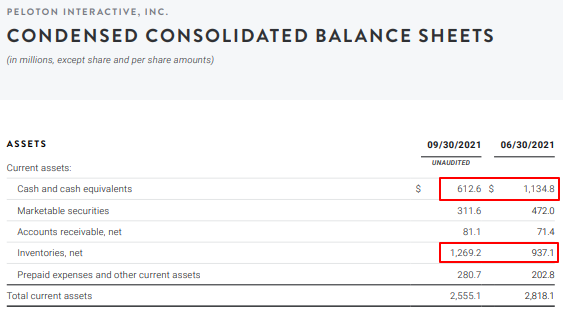

Balance Sheet (vs last Qtr ending June ’20):

- Cash & Marketable Securities: down over $660M … at this burn rate, Peloton would run out of cash in just one quarter

- Inventory up over $330M (accounting for half of the cash burn) to ~$1.27B (about 7-8 months worth of hardware sales at current rates) … the problem is no longer too much demand too little product

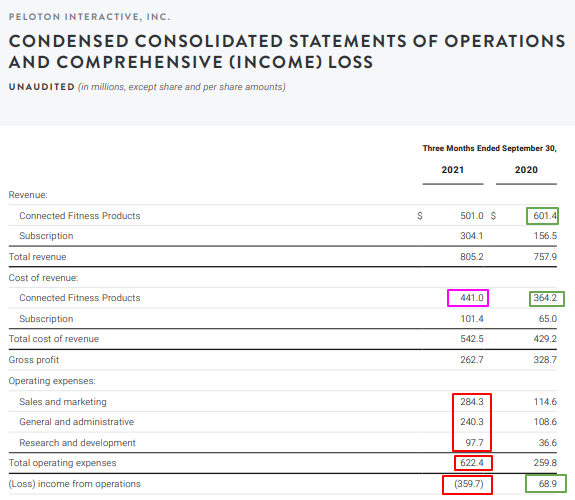

Income Statement (vs same Qtr 2020):

- Swung from $69M operating profit to $360M operating loss

- Gross Margin on Connected Fitness Products (e.g. bikes/hardware) dropped from ~40% to ~12%

- Nearly every item of operating expense is over 2x last year’s, while total revenue grew only 7%. Given the SG&A increase, it is fair to say Peloton is now selling the hardware at a loss

- On a positive note, high-margin subscription revenue nearly doubled from same quarter year ago

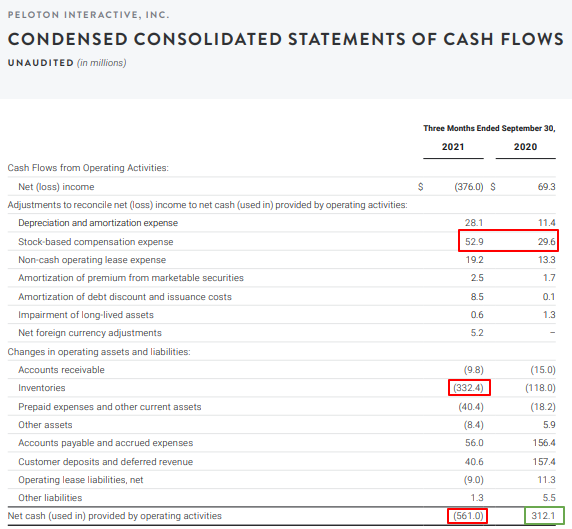

Cash Flows Statement (vs same Qtr 2020):

- Operating activities swung from $312 net generated cash, to negative ($561) cash drain, a swing of $873M in the wrong direction (higher than total revenue)

- Stock compensation expense doubled, suggesting ballooning hiring and stock awards as the problems are mounting

See the Peloton 10Q and letter to shareholders here

So, What’s Pricing Got to Do With This?

For most of its existence, Peloton got virtually all of its revenue from two sources: the Bike, and the Subscription. Because the Bike revenue is all upfront and large, while subscription revenue is over time, the Connected Fitness Products (e.g., Bike, joined more recently by Bike+ and the treadmill (Tread), has produced the majority of Peloton’s revenue.

Repeated one-size-fits-all, dramatic price cuts in core offering

Peloton twice took down the list price of the Bike:

- Sep 2020 from $2,245 to $1,895 (16% cut, while introducing the fancier Bike+ @$2,495)

- Aug 2021 from $1,895 to $1,495 (further 21% cut, widely seen as a response to last quarter’s poor performance and slowing growth)

On the Subscription side, Peloton has:

- A $39/month All-Access for the owners of one of its Connected Products. This price has stayed the same in recent years. Peloton smartly banked on the purchasers of its high-priced gear to be “stickier” due in no small measure to the “sunk” cost in the device itself. Those few who own multiple Connected Products pay this fee only once.

- A $12.99/month Digital subscription for everyone else (to use its classes on most digital devices AND available through some competitors’ bikes as well). This was cut from $19.49 in late 2019.