The Missed Opportunity

It’s back-to-school season, and for many of us that means more e-commerce purchases from direct-to-consumer or digital retail stores. Whether it’s this season or any other, I am always puzzled by the relatively high % of packages / consumer brands that miss a seemingly humble, yet important and near-free opportunity to be proactive and … better.

Specifically, they miss the package insert, an underrated tool to improve customer lifetime value (#CLV) and pricing segmentation optionality. The box comes with just the product (sometimes itself unattractively packaged).

When it happens (all too often), this is a self-goal, particularly grievous if it’s on a first order from a particular store / brand. Do brands have their own back-to-school opportunity here?

Chief Complaint Candidates in E-commerce

Consider some of the main challenges (sometimes voiced as complaints) of most e-commerce / direct-to-consumer sellers:

- Customers are expensive to acquire (and getting more so!)

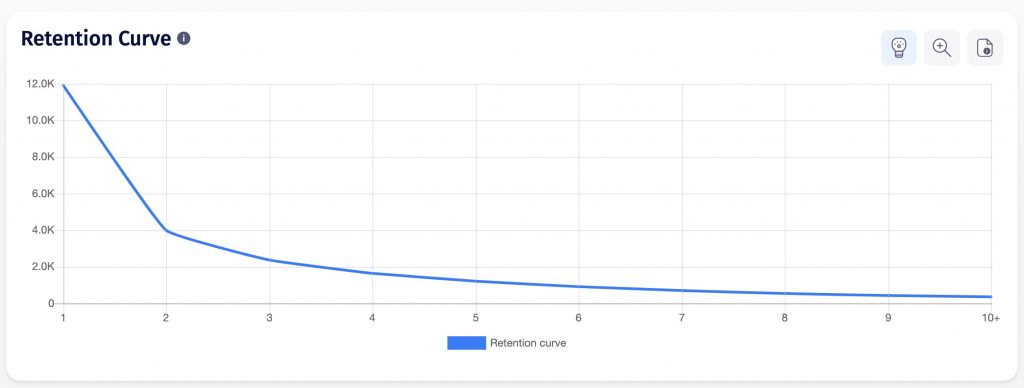

- The % of each cohort EVER placing a second order is low, often in the 20-30% range (one of the hardest realities of e-commerce)

- (For brands selling through Amazon / other online retailers) The retail partner takes a huge cut of any profits (much lower margins than DTC or owned-retail)

- Don’t know enough about customers to assess willingness-to-pay, or ROI on advertising

What can a humble package insert do for pricing strategy & CLV, anyways?

A package insert, placed where the end consumer can hardly avoid seeing it, seems like a golden opportunity to have some influence, however small, on each of these outcomes. And, let me repeat, it’s virtually free! (more nuance on this below).

The package insert can give your end consumer:

- An incentive to place a second order directly from the #DTC website of the brand

- An incentive to register on the website / opt in (valuable data!)

- A physical reminder to consider the brand in the future / accelerate orders for future needs

- FOMO on some limited time offer

- An opportunity to tell you something about their volume and price sensitivity needs by acting on an offer

- An opportunity to learn something they didn’t know about the product / brand / future offers

Some industries are masterful users of this opportunity (wine clubs come to mind). Others are very much hit or miss (pet food, auto parts).

Why would a brand, given a chance to place a physical advertisement in the end consumer’s home, pass as so many do?

So why NOT do it?

I can think of three fears:

- The actual insert cost

- If you sell higher ticket orders (wine club!), this cost, even if the inserts are glossy and the process is manual, is a small % on a very profitable order, and trivial compared to cost of not seeing that customer again for a second / future order.

- If you sell small ticket orders, hopefully you do so at scale. There’s good news here: cost of printing and inserting has great economies of scale (I spent time in that industry, so I’m not just guessing).

- Think Direct Mail, without the cost of postage, to an already opted-in audience … not a perfect analogy, but an appealing one.

- The fear of cannibalization (we think that second / next order would have happened at full price anyway)

- This feels more likely for customers who already placed 3-4 orders, and have already ordered / registered on a brand’s own DTC site (at that point the likelihood of another order is much higher than for the 1st or 2nd order, and the upside is much smaller). However, by that point either the brand or the digital retail partner (Amazon) should know this is a “no insert” or “different insert” customer and either adjust the insert to another (not yet achieved) purpose, or skip it altogether.

- Worst case, you are giving your best customers, the repeat order givers, a better value and chance to self-select themselves as price sensitive by “doing the work” to retain the insert, claim the code, etc. There is value in that data way above the cost of the insert.

- Fear of fairness arguments from retail partner, if the customer was acquired on their site and you appear to redirect to your site.

- As long as the CLV pie from the customer is getting bigger, sharing gains w/ the partner is a terms and negotiation item that can increase ROI for both.

Conclusion

While in some specific cases there is a “good reason” to skip an insert, in most cases I notice I believe it’s just another brand neglecting an opportunity. Some may believe it “too logistically complex” so kudos to Bazic Products who somehow cleverly and creatively pull it off, even for low AOV orders. Who wouldn’t want to join BazicBuddies when we’re anxious about going back to school, and the gauntlet of making or keeping real buddies?