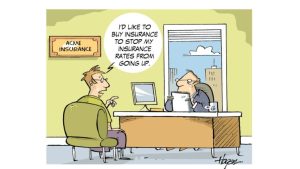

Illustrating the point

One word: Crypto. It presents us with quite the value based pricing conundrum. There has always been the uncomfortable moment when this or that crypto believer (or pusher) is asked to explain what gives Value to crypto assets (aside from psychological failings of human nature like greed, fear-of-missing-out (FOMO), pyramid schemes, and the theory of the greater fool).

The answers virtually always range from ideological (stick it to banks, governments, the man) to technological (the bells and whistles of the tech are amazing) to outright “you have a pain point therefore it follows THIS will solve it” (because governments print money and we don’t print more bitcoin, it follows bitcoin solves the inflation problem). To those of us who live in the world of value-based pricing (e.g., what price you charge should follow from what value you provide), the disconnect was nearly too wide to reduce to words.

Listen to the old guys when it comes to “new assets” and value based pricing?

From “old-style” investors like Warren Buffett / Charlie Munger, to people with a stake in stable markets (SEC / Federal Reserve officials), the commentary about crypto assets and prices always came back to this skepticism: how does this produce some sort of value? It doesn’t produce cash, goods, services and it doesn’t help companies make more profit. It certainly isn’t a “stable” store of value, and the wild fluctuations in prices suggest nobody really knows what they’re worth (or why). So how do we get back to the basics of value based pricing?

The collapse of FTX and “wunderkind” Sam-Bankman Fried‘s sudden rendition to a sorry kid who was allowed to get way over his skis by collective tulip mania has been spectacular. So much so, that it’s easy to forget it’s nowhere close to the only scandal in crypto, or evaporation of everyman’s investments related to the “asset class.” (the classification of crypto as an “asset class” is in itself a feat of collective imagination that leaves Buffett, Munger, and us grasping at the surreal).

In the end, as Warren wisely put it, anyone can pay any price for anything … it means nothing more than that someone has been found willing to pay that price. When the dust settles though, the ability of a “crazy” price to persist, or indeed of an asset to appreciate, does return to that prosaic, yet fundamental question: what is its value? What stream of future cash flows, goods or services does it produce, and how those translate into benefits customers are willing to pay for?

Crypto skipped the “future cash flows, goods or services” step. Sadly, as a result, for many investors “value is what you get” may become “closer and closer to zero is what you get.”

Fine-tuning the point: crypto, Buffett, and value based pricing

Quotes are memorable because they may sound like universal truths. In practice, they rarely are. So for every quote we feature at EBITDA Catalyst, we will provide some caveats, if we believe without them readers could misunderstand or misapply the quote. The following caveats apply to Warren Buffett’s quote, in our view:

- Some assets that require only ONE buyer at a time (works of art, unique collectibles for example) could be subject, on the surface, to similar questions as crypto. But that would be a flawed comparison. With decades or centuries they have spent established as unique symbols of human achievement, or of a particularly meaningful moment or event or person in human history, such objects deliver emotional and status value. They, ultimately, deliver a service: elevating the status and visibility and public persona of their owner, perhaps alongside granting them membership into a community of collectors that tend to be rich and powerful. They are a kind of ticket to an experience of exclusivity that humans from the age of the Pharaohs have always placed substantial value on.

- We would have loved if Buffett’s quote was even more specific “Value is what you get, eventually.”

Want more Catalyst Quotes and other insights?

Follow EBITDA Catalyst on LinkedIn: https://www.linkedin.com/company/ebitdacatalyst/

Check out our Pricing Quotes page, where you can submit your own favorite. If you are a pricing professional or someone who just thinks about pricing a lot, feel free to submit your own words of wisdom and we will quote YOU (if we find it quotable)! https://www.ebitdacatalyst.com/quotes-on-pricing/